GD-PI Topic 2020: Indian Economic Slowdown Reasons

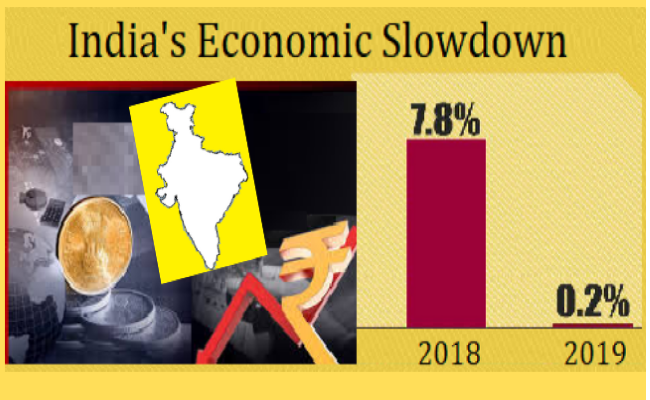

The dream Indian economy of achieving $5 Trillion by 2024 received a major setback when the GDP growth rate slumped at 4.5% in the second quarter of the 2019-20 financial year. It stands in stark contrast from the 7.1% second-quarter growth rate of 2018-19.

The slowdown of the Indian economy became the talk of the month throughout the world when the GDP growth rate number was announced. India with 8% growth rate, at that time, was the fastest-growing economy in the world.

So what went wrong in the second half of 2019? What are the factors causing the economic slowdown? This article will help you to understand the reasons for the Indian economy slowdown in 2019.

What does economic slowdown mean?

The economic slowdown means slowing of the growth rate. Some of the prime reasons for slower growth rates are:

- Lower Consumption Rate

- Rising Unemployment

- Low Demand= Low Sales

- Liquidity Crunch

Factors Responsible for the Economic Slowdown

How did India’s GDP growth rate decrease from 8% to less than 5%? As per the RBI report of September 2019, the root causes of the economic slowdown is the reduction of the domestic consumer demand and lower capital investments.

- Demonetization: India has always been a cash-based economy. The demonetization of 2016 resulted in the massive withdrawal of cash from the market. As per a news report, the demonetisation became the stepping stone of the consumers limiting their overall spend. This also hit the rural markets that are heavily cash-dependent, hypotheses various economists. As predicted by experts earlier, this became a long-term factor that keeps affecting the Indian economy.

- Liquidity Crunch: The Shadow Banking Crisis of 2018 is the triggering cause of the 2019 Economic Slowdown in India. Shadow Bank in India usually refers to the Non-Banking Financial Companies (NBFCs). As the name suggests, these are not like the traditional banks with which we are familiar. The NBFCs are banking institutions that do not have banking licenses but offer different kinds of banking services like insurance, loans & advances, financing, etc. They lend out long-term loans but raise short-term funds.

Trigger: The declaration of bankruptcy by the IL&FS in 2018 put a stop of fund transfer to all NBFCs from public and private banks. With the NBFCs not having enough money to loan, the flow of credit in the economy got disrupted. In this process, the credit capacity of small and medium businesses was influenced.

- Decline in the Automobile Industry:- The automobile sector hit one of its worst crisis of recent years in August 2019. The already declining sales reached its peak resulting in many factories to stop further manufacturing process and causing over 2 lakh job losses. The automobile sectors contribute more than 20 per cent in India’s manufacturing GDP. A large crisis like this will have a direct impact on the Indian economy slowdown.

Trigger: The overproduction of automobiles and the decline of consumers lead to a huge pile-up of vehicles. Even festive season discounts could not boost sales. Moreover, the recent hike in petrol prices also implied to the rise in maintenance cost of the vehicles.

The slowing of income also remained an important cause for consumers not spending their money on buying cars/ bikes. The government plans to roll out BS-VI standard vehicles by April 2020.

This will cause the vehicles manufactured following BS-IV standard to go out of the roads. Consumers thus restrained themselves from buying new vehicles to prevent their loss.

But the most important factor for the automobile sector crisis can be attributed to the severe liquidity crunch faced by the NBFCs.

The prime cause of their involvement in this sector is that they help in generating the automobile sale. The NBFCs also provide loans to automobile manufacturers. According to a report by the chief economist of SBI, the shadow banking crisis had 30% to contribute to the auto industry mess.

- Lower Investments: Investments play a vital role in the economy of a country. New investments open job opportunities, increases business activities. However, factors like demonetisation and the liquidity crunch got the private investors to think twice before investing in India. As per a news report, the new private sector investments fell 70% in comparison to 2018.

- Rising Unemployment Rate: The latest report of NSSO highlights that the unemployment rate of India is at 6.1% and witnessing a 45-year high. Unemployment equals to no earning. Without any source of income, the spending capacity also decreases. Thus the consumer demand also goes down. A higher unemployment number tells a lot about the capacity of the economy. If the economy is not able to tackle this problem, it can be because there aren’t enough measures to do the same.

- Lower Agricultural Growth: Agricultural growth is down spiralling every quarter in recent years. According to a Ministry of Finance report, the agricultural growth declined from 5.1% in 2018-19 to 2% in the 2019-20 FY. This not only affects the farmers’ income but also the sales of the companies involved in agri-based product manufacturing. The onset of monsoon in India plays an important role in the cultivation of several crops. The delay in monsoon implies to the delay in cultivation and consequently impacts the sales of the harvest. In the opinion of the RBI, several factors affected the farmer’s income and subsequently led to a crisis in rural markets.

- Real Estate Slowdown: Like the auto industry sector, the real estate sector also faced a serious crisis in 2019. The growth of this sector fell by 5 per cent from the previous year. Without any investments, there could be no real estate projects. People were not buying houses as other sectors’ employees were already affected by the overall slowdown. According to a report, the real estate sector accounts for over 30% of jobs throughout the country. With no new projects, the jobs of the real estate sector were also hit.

While these factors are the main reason for the 2019 economy slowdown of India, the rumours of the slowdown also impacted the consumer choices.